H1 25 Results Confirm the Relevance of Roquette’s Strategy

H1 25 Results Confirm the Relevance of Roquette’s Strategy

- Roquette outperforms its key markets, delivering solid H1 results in current complex market conditions.

- Successful completion of the acquisition of IFF Pharma Solutions1and implementation of a new organization with two complementary Business Groups2.

- +4% turnover growth to €2,371 million (-3% Like-For-Like basis, LFL3) and +18% EBITDA increase to €294 million (-1% LFL), supported by a favorable mix effect and the consolidation of two months of IFF Pharma Solutions.

- +150 bps increase in EBITDA margin to 12.4% (11.2% LFL), driven by IFF Pharma Solutions and the food and nutrition segments, a consistent pricing strategy, and disciplined cost management supported by the Group’s competitiveness program.

-

Reflecting the usual seasonality of Working Capital Requirement and excluding the cash impact of the acquisition, Free Cash-Flow landed at -€150 million.

Lille – September 25th, 2025 – Roquette, a global leader in plant-based ingredients, excipients and pharmaceutical solutions, today announced its 2025 H1 results, following the approval of its financial statements by the Board of Directors.

Thierry Fournier, CEO of Roquette, commented on the period: “The successful acquisition of IFF Pharma Solutions was a key milestone for the Group, leading to the evolution of our integrated operating model. With our two Business Groups, operating under the strong Roquette brand, we are already seeing positive signs of their complementarity in the H1 results.”

In the first half of the year, the Group outperformed its key markets:

- The Health & Pharma Solutions Business Group achieved strong results, driven by the contributions from the recently acquired IFF Pharma Solutions and the starch-based excipient business, which partially offset performance in the capsule segment. “The overall commercial results of the Business Group benefitted from the positive impact of IFF Pharma Solutions, which exceeded the Group’s forecasts. This outcome confirms the strength of Roquette’s strategy to offer a more diversified portfolio covering all drug delivery technologies, along with an expanded geographical footprint. I would add that the integration project is on track to unlock the potential of this combination as expected.”

- The Nutrition & Bioindustry Business Group’s performance was fueled by sustained demand for Roquette’s specialty products, leading to a favorable mix effect, with market share growth in some specific markets. The Business Group’s consistent pricing strategy and effective cost management led to a significant improvement in its EBITDA margin. “The Nutrition & Bioindustry Business Group has increased margins, underscoring the effectiveness of its disciplined commercial strategy. This approach has highlighted the Business Group’s ability to navigate challenging markets and contribute to overall robust results.”

- The Nutrition & Bioindustry Business Group’s performance was fueled by sustained demand for Roquette’s specialty products, leading to a favorable mix effect, with market share growth in some specific markets. The Business Group’s consistent pricing strategy and effective cost management led to a significant improvement in its EBITDA margin. “The Nutrition & Bioindustry Business Group has increased margins, underscoring the effectiveness of its disciplined commercial strategy. This approach has highlighted the Business Group’s ability to navigate challenging markets and contribute to overall robust results.”

In a volatile macroeconomic environment, Roquette remains focused on the seamless execution of its strategy, its competitiveness and its deleveraging. “To effectively execute our strategy, we will focus on three key levers: operational excellence, innovation, and the implementation of our new operating model, all while continuing the successful integration of IFF Pharma Solutions in the short term. This approach is designed to enhance profitability and create value for all our stakeholders going forward,” concluded Thierry Fournier.

HALF YEAR 2025 CONSOLIDATED KEY FIGURES4

| (in millions of euros) | H1 24 | H1 25 | Var. (%) | Var. LFL (%) |

| Turnover | 2,291 | 2,371 | +4% | -3% |

| EBITDA | 249 | 294 | +18% | -1% |

| EBITDA margin | 10.9% | 12.4% | +150bps | +30bps |

| Net result | 26 | (115) | - | - |

| Adjusted net result (a) | 46 | 42 | -7% | - |

| Free Cash-Flow IFRS (before IFF Pharma Solutions) (b) |

(9) | (150) | - | - |

| (in millions of euros) | FY 24 | H1 25 | ||

| Net debt IFRS | 237 | 2,854 | ||

| Restated leverage ratio (c) (net debt IFRS / combined EBITDA) |

0.45x | 3.75x |

(a) Excluding non-recurring items amounting to €164 million (€28 million in H1 24) and associated taxes.

(b) IFF Pharma Solutions acquired on May 1st, 2025

(c) Combined EBITDA includes IFF Pharma Solutions estimated EBITDA over the last twelve months.

FINANCIAL PERFORMANCE

SOLID H1 25 RESULTS IN COMPLEX MARKET CONDITIONS

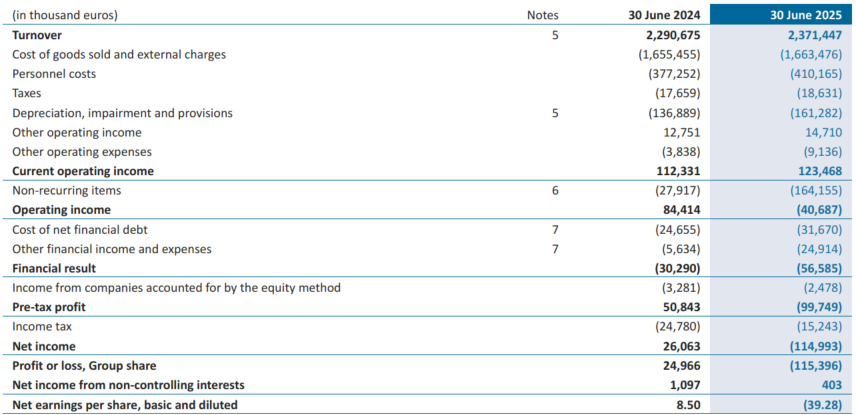

Roquette’s operational performance in H1 2025 showed positive momentum, with turnover and EBITDA up 4% and 18%, respectively (down 3% and 1% on a Like-For-Like basis). This growth was primarily driven by the consolidation of IFF Pharma Solutions since May 1st, 2025, which has shown promising results, and a positive product mix.

In a complex economic environment, the Group maintained operational resilience and focused on its strategic execution, resulting in volume growth of 2% and market share gains in some key markets.

The EBITDA margin expanded to 12.4% (11.2% LFL), up from 10.9% at end of June 2024. This improvement reflects the strong contribution of the higher value-added products from IFF Pharma Solutions and the food and nutrition segment. A more favorable cost environment along with rigorous cost management further reinforced profitability.

Cost management efforts are driven by the Group’s ambitious competitiveness program, initiated in 2023, which has constantly exceeded expectations. Building on its success, the program has been extended from 2026 to 2028 with even more ambitious targets, ensuring continued structural efficiency improvement and sustainable value creation.

The cost of net financial debt amounted to €32 million, up from €25 million at end of June 2024. This increase was expected as it reflected the higher debt volume following the acquisition in May 2025. This was partially offset by lower interest rates as well as by the interest income collected on the €1.2 billion deposit initiated after the inaugural bond issuance in November 2024 until the acquisition.

The other financial charges amounted to €25 million, up from €6 million at end of June 2024, mainly due to the strengthening of the euro against the US dollar affecting the revaluation of some monetary balance sheet items.

The reported net result for the period was -€115 million, compared to €26 million at end of June 2024. This decline mainly reflects:

- non-cash impairment charges of €55 million (Roquette India) and €67 million (Roquette America);

- the anticipated IFF Pharma Solutions and Qualicaps acquisition and integration costs representing €52 million.

Excluding these non-recurring items and the associated taxes, the adjusted net result amounted to €42 million compared to €46 million at end of June 2024.

The Group successfully navigated challenging market conditions in the first semester 2025, including the tariff measures implemented by the U.S. administration. The Group actively monitors the situation, and a dedicated global task force has been put in place to collect data on exposures and impacts. To date, the flows to and from the US affected by the tariffs would represent less than 5% of total turnover (based on contract value in 2025). The Group has a globally diversified footprint that allows to adapt flexibly to changing business conditions, and continuously and proactively adjust strategies to minimize any potential impact. Moreover, regular and constructive dialogue is maintained with customers and partners to ensure supply chain resilience and mitigate potential disruptions.

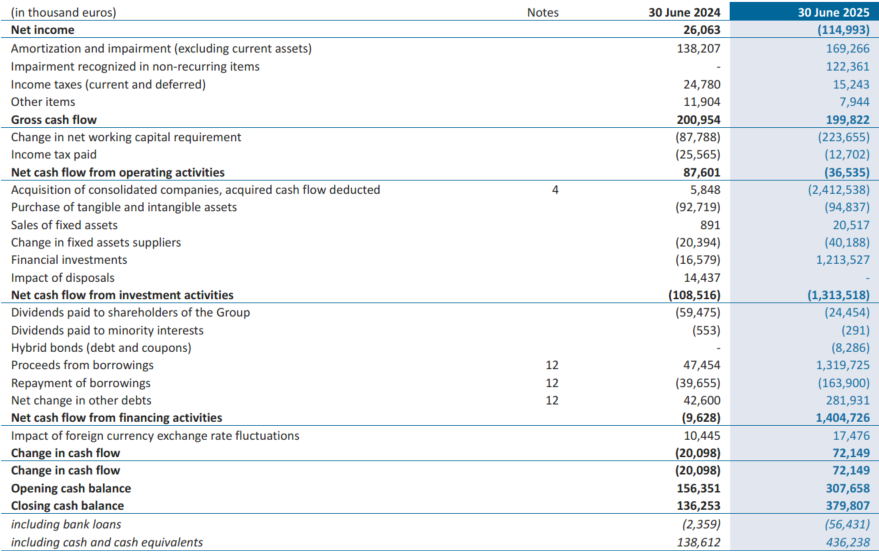

FREE CASH-FLOW GENERATION

| (in millions of euros) | H1 24 | H1 25 |

| Operating Cash-Flow | 176 | 186 |

| Variation in working capital requirement | (90) | (223) |

| Investments paid | (94) | (114) |

| Free Cash-Flow IFRS (before acquisition) | (9) | (150) |

| Acquisition of IFF Pharma Solutions | - | (2,413) |

| Free Cash-Flow IFRS (after acquisition) | (9) | (2,565) |

In H1 2025, Free Cash-Flow stood at -€150 million, from -€9 million at end of June 2024, excluding the cash-impact linked to the acquisition of IFF Pharma Solutions. Several factors underpin this performance:

- Working Capital Requirement reflected normal mid-year seasonality, with increases in inventories and receivables, compared to prior year which was unusually low due to record inflation;

- Operating Cash-Flow increased to €186 million from €176 million, in line with strong EBITDA growth;

-

Capital expenditures remained stable.

PERFORMANCE BY BUSINESS GROUP

HEALTH & PHARMA SOLUTIONS – BOOSTED BY IFF PHARMA SOLUTIONS ACQUISITION

| (in millions of euros) | H1 24 | H1 25 | Var. (%) | Var. LFL (%) |

| Sales | 411 | 546 | +33 % | -8% |

| Eliminations (int. sales) | (6) | (36) | - | - |

| EBITDA | 117 | 145 | +23 % | -16% |

| EBITDA margin % | 28.5% | 26.5% | (200bps) | (250bps) |

Sales amounted to €546 million, up 33% from end of June 2024, boosted by the two months consolidation of the IFF Pharma Solutions acquisition. EBITDA came in at €145 million, representing a margin of 26.5%.

IFF Pharma Solutions delivered results above expectations, driven by strong performance across its portfolio. The starch excipient business demonstrated sustained performance, partially offsetting softer volumes in the capsules category. Excluding IFF Pharma Solutions and the exchange rate impact, sales and EBITDA declined 8% and 16%, respectively.

This resilience underlines the relevance of the Group’s strategic orientation toward diversification to strengthen its ability to navigate fluctuations in specific product lines while maintaining overall profitability.

NUTRITION AND BIOINDUSTRY – STRONG EBITDA GROWTH

| (in millions of euros) | H1 24 | H1 25 | Var. (%) | Var. LFL (%) |

| Sales | 1,962 | 1,923 | -2% | -3% |

| Eliminations (int. sales) | (138) | (130) | -6% | - |

| EBITDA | 132 | 149 | +13 % | +11% |

| EBITDA margin % | 6.7% | 7.8% | +110bps | +100bps |

Sales amounted to €1,923 million, down 2% from end-June 2024 and EBITDA stood at €149 million, with margin improvement to 7.8% (+110bps) due to a positive mix effect.

Demand remained soft overall for commodities due to economic uncertainties, prices declined in line with the raw material price decrease and pressure remained due to lower sugar price in Europe.

Nevertheless, volume grew in Europe, accompanied by a market share gain of over 1 point in some key markets. In contrast, complex conditions are observed in the Americas and competition intensified in India.

The food and nutrition segment continued to deliver strong results, with European volumes growth, driving EBITDA margin enhancement.

This performance demonstrates the Group’s ability to capture value in high-demand categories in challenging market conditions.

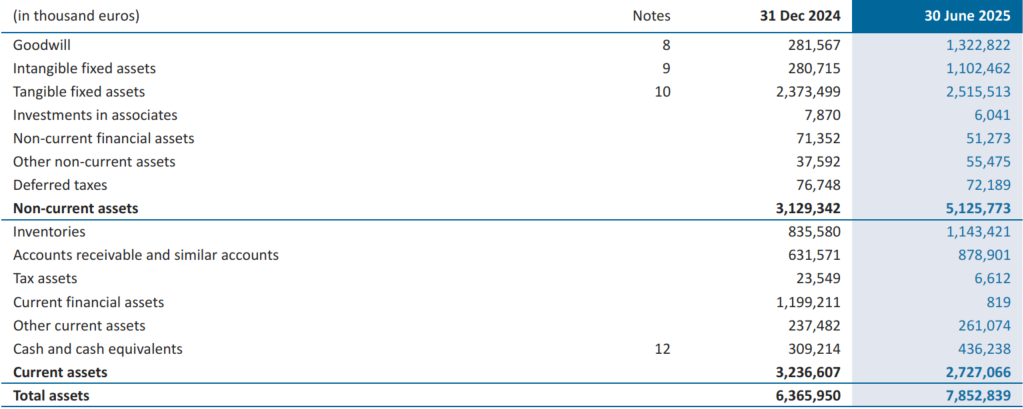

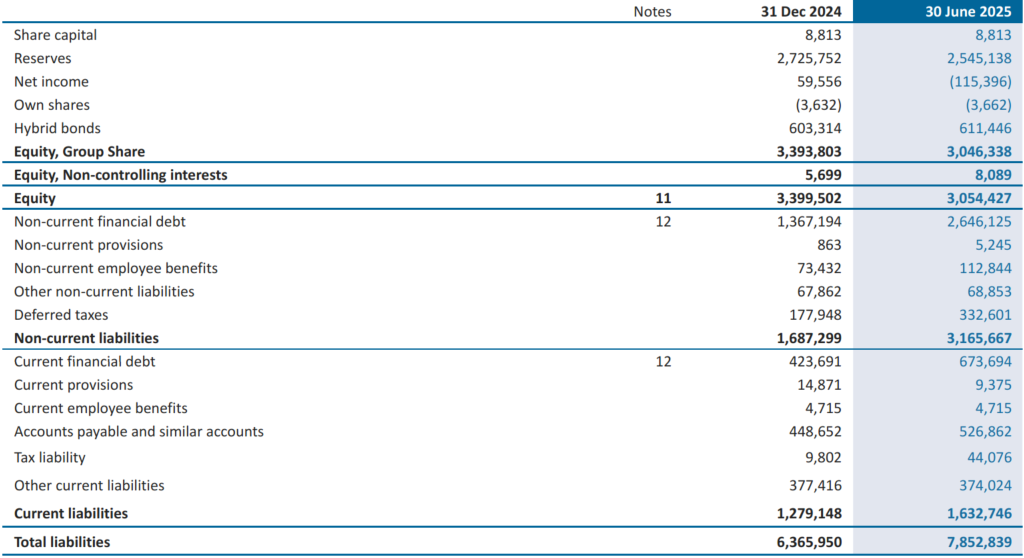

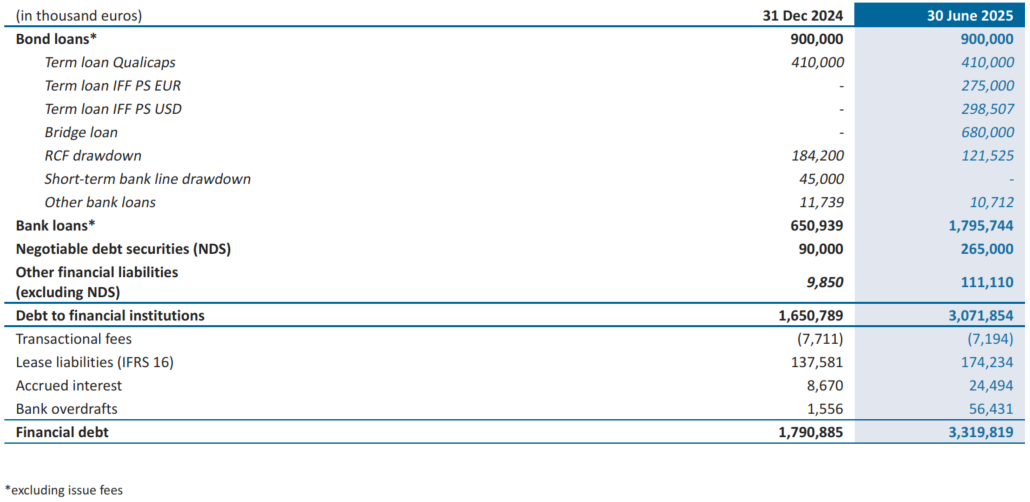

BALANCE SHEET

| (in millions of euros) | FY 24 | H1 25 |

| Financial debt IFRS | 1,791 | 3,320 |

| Cash & cash equivalents and financial investments | 1,554 | 465 |

| Net debt IFRS | 237 | 2,854 |

| Restated leverage ratio (net debt IFRS / combined EBITDA) (a) | 0.45x | 3.75x |

| Gross debt towards financial institutions (cf. Appendix 5) | 1,651 | 3,072 |

(a) Combined EBITDA includes IFF Pharma Solutions estimated EBITDA over the last twelve months.

Strong liquidity and balanced maturity profile

The debt maturity profile is also well-balanced, with no major repayments in the next 3 years - excluding the bridge refinancing in 2026 - and an average debt maturity of 3.7y. In terms of liquidity, as of June 2025, Roquette maintained a strong liquidity position, with over 1.3 billion euros in available liquidity (€0.7bn undrawn credit lines, €0.2bn undrawn commercial papers and cash available).

At end of June 2025, the Group’s net financial debt rose to €2,854 million, compared with €237 million at end-December 2024. This level reflects the anticipated impact of the IFF Pharma Solutions acquisition completed in May 2025.

Consequently, the restated IFRS leverage ratio reached 3.75x considering a conservative calculation for the estimated last twelve-month combined EBITDA, leaving headroom under covenants and allowing the Group to comply with its financial covenants at end of June 2025.

The Group reaffirms the IFRS leverage ratio target of 2.3x to 2.7x by 2027, remaining fully committed to maintaining a strong Investment Grade rating.

Status of the accounts:

The limited review procedures on the HY 2025 consolidated financial statements have been completed and the limited review report will be issued on the 25th of September 2025. It will include a qualification as the Group completed the acquisition of the IFF Pharma Solutions in May 2025, following significant legal reorganizations (including carve-out transactions), and while Management is working to stabilize the impact of these changes, it was challenging to fully substantiate certain balance sheet items at the acquisition date and at June 30, 2025. However, the reported figures are consistent with expectations and the IFF Pharma Solutions audited combined financial statements on December 31, 2024. Integration efforts are expected to clarify the balance sheet and support the contribution of the acquired entities to the Group’s results for the 2025 year-end closing.

About Roquette

Roquette is a leading provider of plant-based ingredients, excipients and pharmaceutical solutions dedicated to enhancing the quality and convenience of essential products for consumers and patients worldwide.

Roquette employs more than 11,000 people globally, operating in more than 150 countries through more than 40 manufacturing sites and 20 R&D and innovation centers. The company achieved a turnover of €4.5 billion in 2024.

Harnessing natural resources like wheat, corn and cellulose, Roquette crafts high-performance ingredients and solutions used in everyday foods, oral medications, advanced biopharmaceuticals, and bio-based products.

Roquette is a family-owned company driven by a long-term vision and a constant commitment to innovation. For almost a century, Roquette has been empowering better living and building a sustainable future by offering the best of nature.

Discover more about Roquette here

Press contacts:

Brunswick

Antoine Parison

+33 (0) 7 88 72 28 95

aparison@brunswickgroup.com

Roquette

Corporate Communications

Susannah Duquesne

Susannah.duquesne@roquette.com

Financial Communications

Eloïse de la Chaux

eloise.de-la-chaux@roquette.com

DISCLAIMER - Certain statements contained in this press release may contain forecasts that specifically relate to future events, trends, plans or objectives. By nature, these forecasts involve identified and unidentified risks and uncertainties and may be affected by many factors likely to give rise to a significant discrepancy between the actual results and those indicated in these statements. The group does not undertake to publish an update or revision of these forecasts, or to communicate on new information, future events or any other special circumstance. The amounts presented in this presentation have been rounded to the nearest hundred/unit, which may result in slight discrepancies in totals. Thus, the financial data is provided for informational purposes only and may not exactly match the figures in the consolidated financial statements.

FINANCIAL INFORMATION - This press release and Roquette's full regulated information are available on the Group's website: Roquette website

GLOSSARY

To measure its performance, the Group uses certain financial indicators that are not defined by IFRS standards. These indicators are used in the operational monitoring of the Group’s activities and its financial communication (press releases, financial presentations, etc.).

| Alternative performance indicators | Definitions and reconciliation with IFRS indicators |

| EBITDA | EBITDA corresponds to the consolidated current or recurring operating income of the Group for that period, after adding back all amounts deducted from consolidated current or recurring operating income for depreciation, amortization, impairment on fixed assets, net amounts related of fixed assets write-offs, insurances and investment subsidies, non-core business or non-business-related incomes or charges. |

| Operating Cash-Flow | Operating Cash-low corresponds to the Cash-Flow generated by operating activities (from the consolidated Cash-low statement), plus the change in net working capital, the unrealized financial result on operating receivables and payables, the “net impairment of current assets” (impacts the operating Cash-Flow) and “other reconciling items”. |

| Free Cash-Flow | Free Cash-Flow corresponds to Cash-Flow after investments (from the Cash-Flow statement derived from the consolidated financial statements), to which is added the change in other current assets (for Short-term investments, which are included in the aggregate “Net debt”), the change in other non-current assets (for long-term investments and receivables related to equity interests, which are included in the aggregate “Net debt”) and “Other reconciliation items”. |

| Working Capital Requirement | Working Capital Requirement corresponds to the short-term net assets needed to operate the activity. Calculation is defined in the annual consolidated financial statement of 2024 in the Note 26. |

| Net debt | Net debt corresponds, on the basis of the consolidated financial statements, to non-current financial liabilities, current financial liabilities, minus cash and cash equivalents, as well as Other current assets (for Short-term investments in “Current and non-current financial assets”, which are included in the aggregate “Net debt”) and Other non-current assets (for Long-term investments and Receivables related to investments and loans in “Current and non-current financial assets”, which are included in the aggregate “Net debt”). |

APPENDIX 1 – INCOME STATEMENT

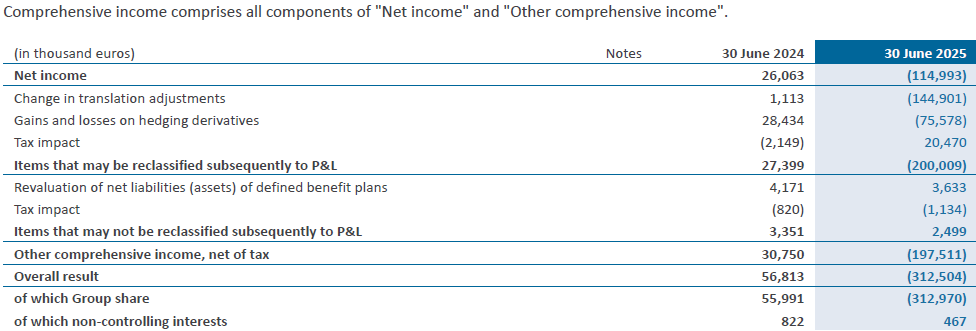

APPENDIX 2 – COMPREHENSIVE INCOME STATEMENT

APPENDIX 3 – BALANCE SHEET

APPENDIX 4 – CASH-FLOW STATEMENT

APPENDIX 5 – GROSS DEBT TOWARDS FINANCIAL INSTITUTIONS

1 Completion of Roquette's acquisition of IFF Pharma Solutions

2 New Organization following the Acquisition of IFF Pharma Solutions

3 Like-For-Like basis excludes exchange rates impact and perimeter variation.

4 The definition of the alternative performance indicators is provided in the appendices of this press release.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.